Margin trading, or margin trading, is a relatively new innovation in the cryptocurrency market. As a result, investors are given the opportunity to invest with the help of financial leverage, which in turn enables them to get an even greater return on investment.

On the pages of bitcoin.pl we have already written about basic issues related to margin trading. If you want to learn more about margin trading or the leverage itself – check out our articles.

Today, however, we will look at the most interesting positions in the cryptocurrency market when it comes to margin trading. We present three different options – convenient depending on your needs.

Binance

Binance only needs to be included in this list. The largest cryptocurrency exchange in volume also provides the opportunity to trade with leverage. In order to trade margin trading, we must verify KYC.

Remember that Binance is an environment that is much bigger than just a trading exchange. The platform functions as a regular change of location and has a range of financial services for its customers in its turn. Deposit trading is one such option there. The amount of leverage here depends on the selected asset. In some cases, the maximum value is 5x and sometimes 10x.

For trading on Binance, we can also use Binance Coin, which gives us a 5% discount.

Binance is not a company that we can use in all countries. It is currently not available in a number of countries – USA, Albania, Belarus, Bosnia, Burma, Central African Republic, Congo, Korea, Ukraine, Croatia, Cuba, Herzegovina, Iran, Iraw, Kosovo, Lebanon, Liberia, Libya, Macedonia, Moldova, Serbia, Somalia, Sudan, Syria, Venezuela, Yemen and Zimbabwe.

Huobi Pro

Huobi is an international cryptocurrency exchange known for its international platform and support. Its offices are located in Hong Kong, Korea, Japan and the United States. To start using Huobi, we need to create an account on the exchange and then go through the KYC procedure required to start the operation. It is worth preparing documents.

As in the case of Binance, we at Huobi can use the functions in the Spot Exchange, as well as use the margin trading alternative. Some of the coins offered have the option of using financial leverage. in the case of BTC we are talking about the 5x level.

The user-friendly interface will be a big plus for Huobi users.

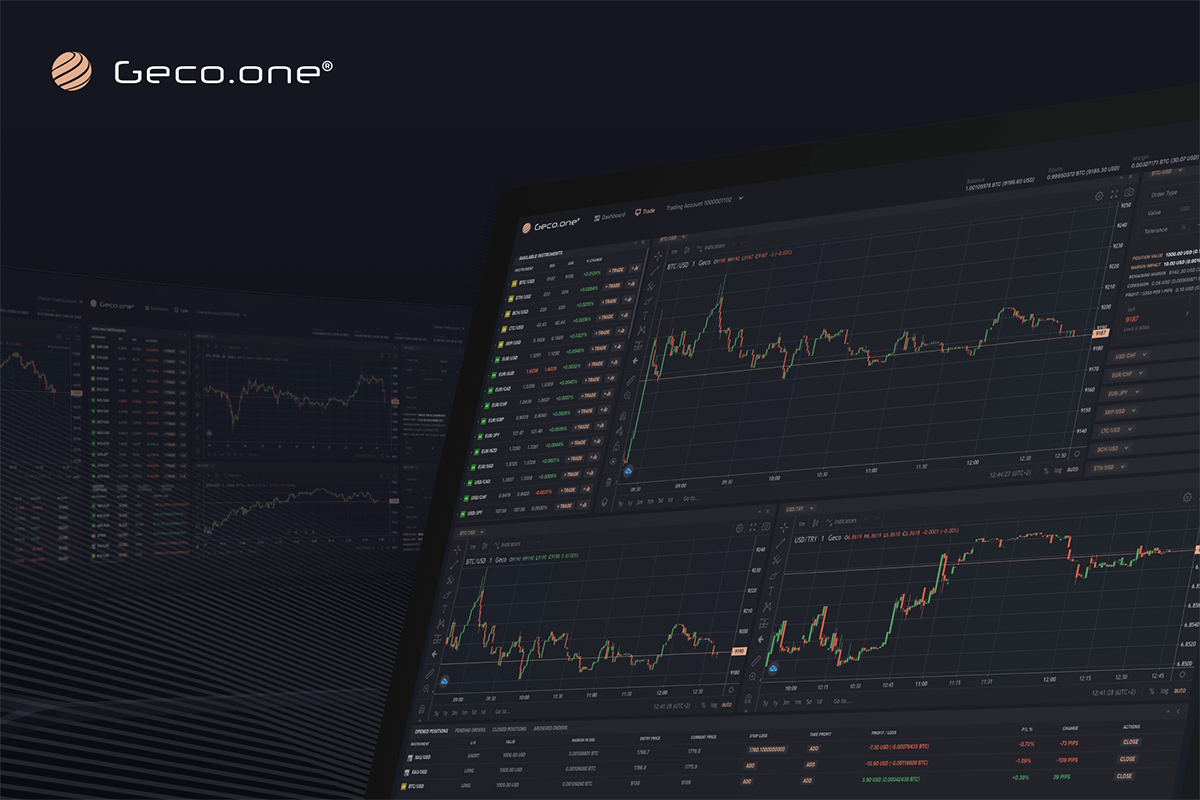

Geco.one

On our list, Geco.one works like a black horse. However, this relatively young stock exchange with Polish roots boasts a fairly high volume, which recently exceeded one billion dollars.

Why does Geco.one deserve the attention of investors? There are two main reasons. First and foremost, this platform is completely focused on deposit and leverage trading. This is manifested in the lack of a regular order book. In return, the stock market is served by an external liquidity provider – an advantage? First and foremost precision. The profit is no longer dependent on other users filling in the order book. Geco.one thus avoids the risk of price decline, which is so important when trading with high leverage.

Lever! This is the second reason why you should pay attention to Geco.one. On this platform we can trade any coin with a maximum leverage of 100 times. Compared to the Spot exchanges, which offer marginal trading as a supplement – this is a big leap in quality.